Which of the Following Are Common Protective Covenants

After the Grantor Control Period Lessor shall assign to Lessee any rights which Lessor may have under the terms of the Protective Covenants to audit the Owners Associations calculation of the Assessments as such pertain to the Premises. Protective covenants are offered for the benefit of common stockholders.

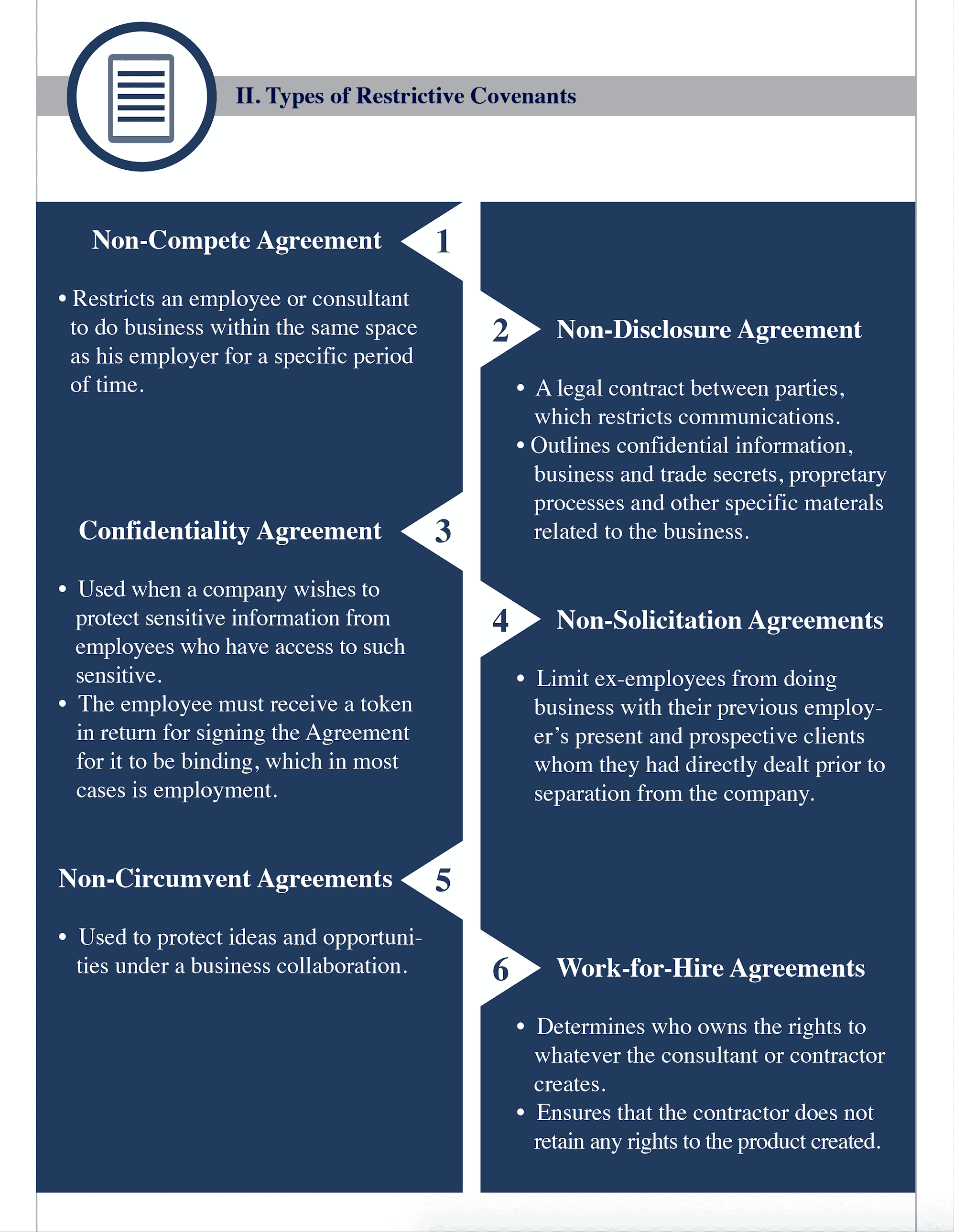

Negative Covenants Types Bonds Restrictive Covenant Examples

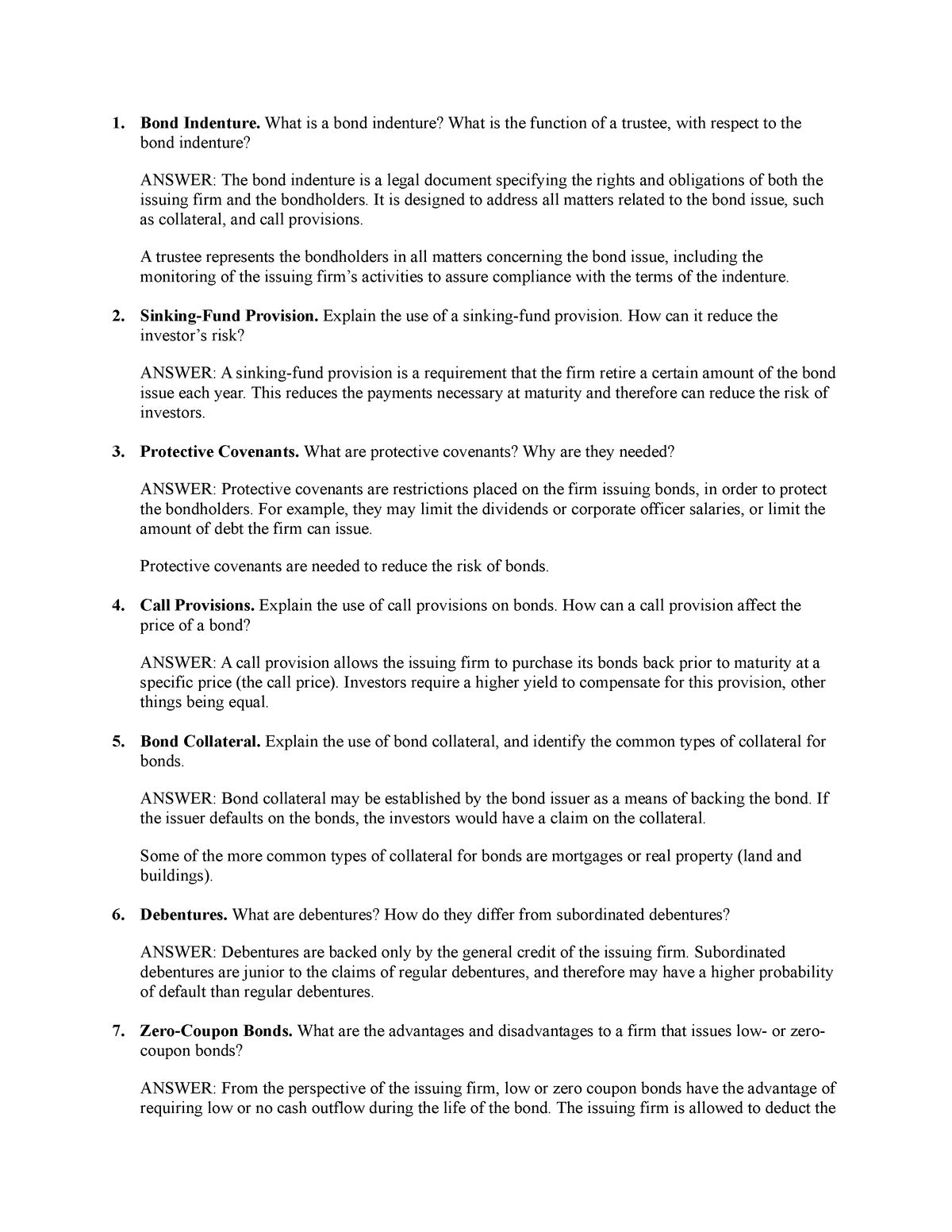

An indentures or loan agreements section or paragraph can contain a protective covenant.

. Security features include the assignment of payments due under a specific contract to the lender. The borrower is required to maintain a minimum level of liquidity. Mar 25 2018.

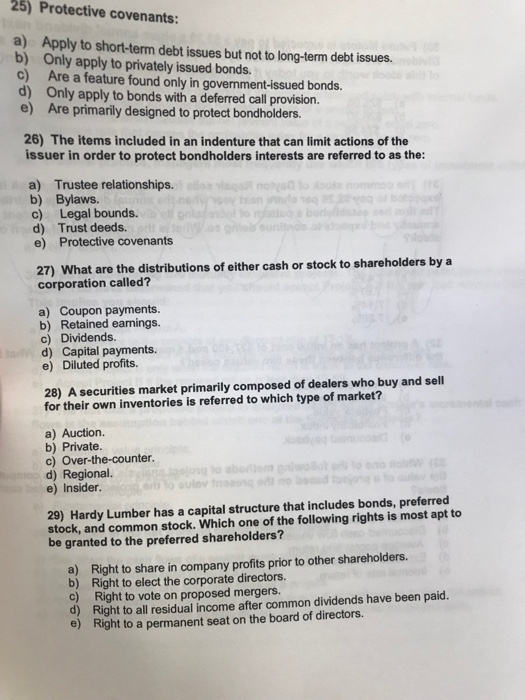

They are usually undertaken by a lender as a measure to reduce the risks Credit Risk Credit risk is the risk of loss that may occur from the failure of any party to abide by the terms and conditions of any financial contract principally associated with lending their money. Below is a list of the top 10 most common metrics lenders use as debt covenants for borrowers. The firm must not pay dividends to common stockholders.

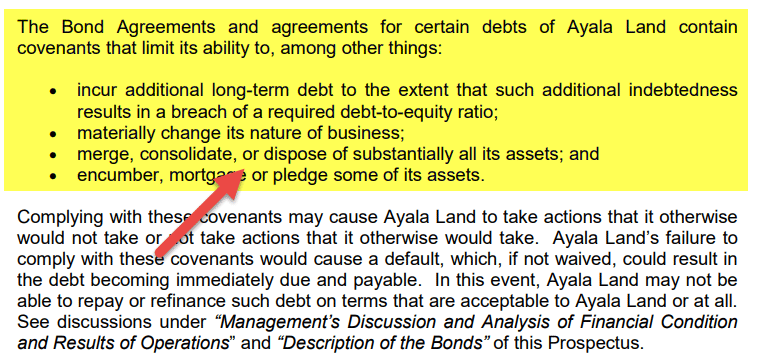

Protective covenants are offered for the benefit of bondholders. DebtEBITDA Ratio The net debt to earnings before interest taxes depreciation and amortization EBITDA ratio measures financial leverage and a companys ability to pay off its debt. Protective covenants are restrictions that are built into contractual agreements that place restrictions on the firms investment financing and dividend decisions.

To these Protective Covenants in the event of conflict between these Protective Covenants and ARTICLE XI of the Declaration. It has become increasingly commonplace for a subdivision to be subjected to a set of protective covenants also referred to as restrictive covenants. Lenders from early calls of their bonds.

Of the Protective Covenants. Its purpose is to limit a companys scope of action on a specific property. Company in the case of rising interest rates.

Non-solicitation covenants preventing the seller poaching existing clientscustomerssuppliers and employees of the acquired business for a specified period. Lenders from company actions contrary to the lenders benefit. CAmendment Rescission or Additions.

Which of the following would be considered as a positive protective covenant. Non-dealing covenants preventing the seller from dealing with existing clientscustomerssuppliers for a specified period. Thus a protective covenant safeguards a lending institutions interests during a loan term investment credit or mortgage In addition people often refer to.

Importance of Financial Covenants. Gitman 2000 lists the following four restrictive covenants as the most common. List of Debt Covenants.

The firm cannot pledge any assets to other lenders. Making a single-sum payment at final maturity. Bonds with protective covenants sell at a higher price than otherwise equivalent bonds without such protection for their investors.

Company in the case of rapid growth. Negative covenants include limits on the amount of dividends that might be paid c. Bond covenants are designed to protect the interests of both parties.

Where to draw the line. The usual process involves a developer of a subdivision recording a set of covenants in the land records at the very beginning of the development. All of the above.

If during the Grantor Control Period Lessee disputes. Sale of seventy-five percent 75 of the lots in the development or three 3 years from the recording of the Declaration of Protective Covenants. Financial covenants serve the purpose of a safety net for the lender.

A common penalty for violating a bond covenant is the downgrading of a bonds rating which could make it less attractive to investors and increase the issuers borrowing costs. Negative or restrictive covenants forbid the issuer from undertaking certain activities. Which of the following is not true about security provisions and protective covenants.

For example Moody. Which of the following is the holder of a warrant allowed to do. To protect the interests of the company.

The description of the Development as set forth in the Declaration of Protective Covenants for The Hideout dated May 11 1970 is hereby amended to include not only the real estate therein. The firm must pay dividends to shareholders on time. The POA Board of Directors its successors and assigns may amend rescind or add to the Protective Covenants from time to time but unless.

The general purpose of protective covenants is to help protect the. The Declarant reserves the right which it may exercise in its sole discretion to convey the road system in The Meadow. The firm must not issue additional long-term debt.

Limitations on the amount of working capital that the borrower can.

Solved 25 Protective Covenants A Apply To Short Term Debt Chegg Com

Solved Identify Common Terms Used In Bonds And Drag The Chegg Com

Chapter 7 Homework Bond Indenture What Is A Bond Indenture What Is The Function Of A Trustee Studocu

No comments for "Which of the Following Are Common Protective Covenants"

Post a Comment